Somalia's Porous Banking Can Be A Gateway for Money Laundering, Terror Financing

|

08 June 2024 02:51

MOGADISHU, Somalia (HORN OBSERVER) - In recent years, Somalia has emerged as a significant source of remittances for its neighboring countries, Kenya and Uganda.

Diplomatic sources reported in April this year that Somalia accounts for $180 million and $21.9 million in annual remittances to Kenya and Uganda, respectively.

However, this influx of money is not entirely a cause for celebration.

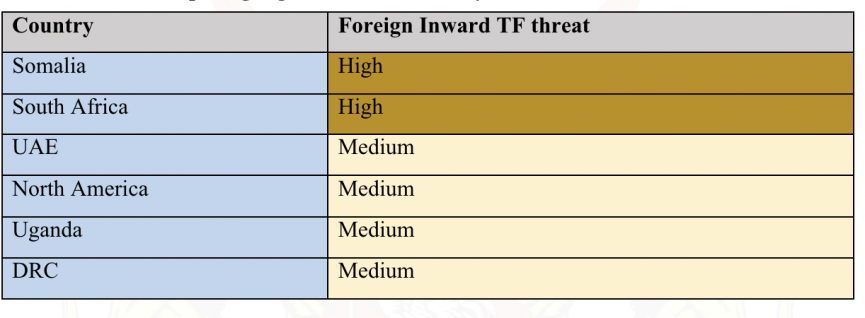

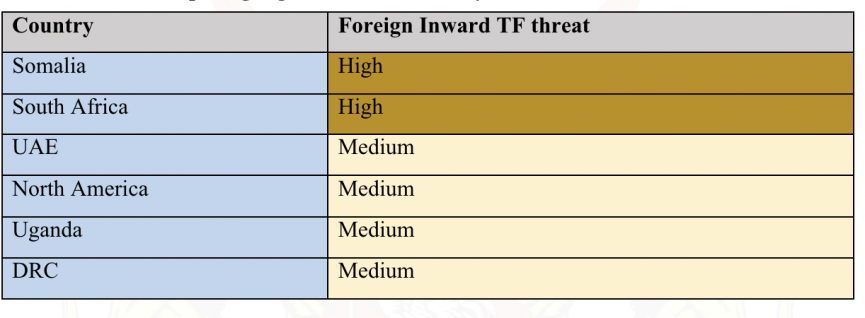

According to Kenya’s National Terrorism Financing Risk Assessment Report published in December 2023, Somalia poses the highest risk of being a source of terrorism financing entering Kenya through both legal and illegal channels. The large sums of money collected within Somalia have been identified as a significant threat.

South Africa is ranked a second position of countries that pose high risk due to similar money transfer typologies exhibited by terrorist groups like ISIS.

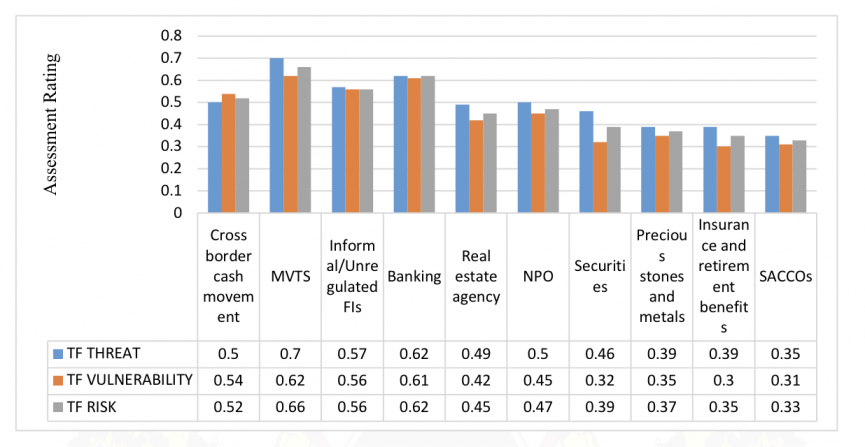

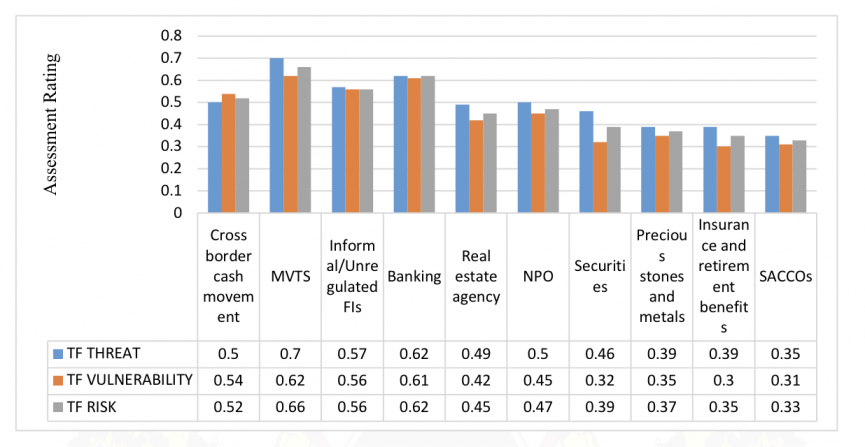

The report highlights the real estate sector as a prominent avenue for laundering money into Kenya.

"In fact, the real estate sector was identified as a medium-risk sector in the NRA due to the weak legal frameworks," the Kenyan government report stated.

REAL ESTATE MONEY LAUNDERING

This week, Somali Member of Parliament Abdirahman Abdishakur Warsame revealed that millions of dollars of stolen money are being laundered into Kenyan real estate.

"Young men employed by the government are now boasting to each other that they have bought real estate in Nairobi, Kenya, and Turkey. Where is this money coming from?” MP Abdishakur questioned during a press conference in Mogadishu on Tuesday. "The Somali people must know that there will be a day this money will be investigated and perpetrators held accountable."

The sources of the money entering Kenya are believed to be twofold. Criminal and terror groups, such as Al-Shabaab, ISIS, and pirates, seek to conceal their funds, while corrupt politicians use illegal proceeds to invest in real estate.

"Due to its proximity to Somalia and progressive economy in East Africa, Kenya is seen as a good choice for the criminal and terror groups in Somalia,” said Abdulkadir Nur, an expert on anti-money laundering activities. "While Kenyan authorities are trying their best, sadly there are insufficient regulations to detect these criminal activities originating from Somalia.”

Intelligence sources have confirmed that both ISIS and Al-Shabaab have increasingly turned to legitimate businesses inside and outside Somalia to sustain their funding. Import and export companies, as well as real estate agents, are often used by these groups.

"In the past two years, the real estate market in Mogadishu has boomed with new tall and expensive building projects built by real estate agents. The true owners and the source of the fundings are never known. These buildings are rented out with agents set to collect monthly rental fees. This is one form of keeping terror financing up and running," Nur explained.

"It is not only happening in Mogadishu, it is also going on in Kenya and Turkey where a good number of Somali diaspora resides," Nur states.

Adding to the problem, Somalia’s Hawala and banking systems are poorly regulated, making it easy for terrorists and criminals to launder money.

In September 2022, a Mogadishu court began investigating missing funds at Premier Bank Somalia, but the case was quickly covered up denying media attention. When Radio Risaala journalists pursued the story, they received threats and were told to keep off.

"The case began after a cashier at Premier Bank Somalia made unauthorized withdrawals of large amounts of money under suspicious names. There were account-to-account transfers containing huge amounts of funds without going through the required anti-money laundering procedures," one journalist involved in the investigation reported.

The Office of the Attorney General in Mogadishu initially announced an investigation in early October 2022, but Premier Bank Somalia intervened according to sources. A subsequent statement from the same office declared the bank "as the victim" rather than "the culprit".

"One of the surprising issues is that the money was being withdrawn tactically by one of Premier Bank Mogadishu's employees. This had been ongoing for almost two years without detection," Radio Risaala reported at the time.

In March 2023, Premier Bank acquired a 62.5% stake in Kenya’s First Community Bank (FCB), marking the first time a Somali lender expanded its banking business beyond the domestic market in over three decades.

Table: Countries posing highest TF risk to Kenya. (Source: Kenya’s National Terrorism Financing Risk Assessment Report)

However, the incident in 2022 is not the only incident reported in recent years inside Somalia. Somali officials at the Financial Reporting Centre acknowledged that Al-Shabaab continues to leverage its influence through threats of violence against bank employees, allowing militant group members to manage local bank accounts without providing identification.

"We have cases where bank employees have actively collaborated with terrorist individuals or have failed to ensure the Know Your Customer (KYC) requirements because they were threatened or their family members were in danger. In such situations, you cannot stop terrorist activities in the banking system, and it remains a concern for all of us," said a mid-rank officer at the FRC who requested anonymity.

Another concern for local officials is that Somali pirates - after receiving ransom money - and other groups are moving large amounts of money to launder through weak banking institutions. One flagged case involves the transfer of more than $3 million from Mogadishu to South Sudan, which is yet to be investigated, according to initial intelligence reports.

The Kenyan government report (December 2023) also notes that the real estate and construction sectors receive a significant share of diaspora remittance investments. However, the client base profile in terms of exposure to terrorism financing risks was considered moderate, mainly because limited KYC is conducted during onboarding, and there is hardly any screening of clients against UN-sanctioned lists.

Table: Real estate among the sectors identified posing terrorism financing risk in Kenya. (Source: Kenya’s National Terrorism Financing Risk Assessment Report)

When contacted by the Horn Observer, Premier Bank Somalia and its subsidiary Premier Bank Kenya declined to respond to queries.

An official at the Central Bank of Somalia told our reporter that they can not comment on the case of Premier Bank at this time.

Leave a comment

- Popular

- Rated

- Commented

04/11/2021 - 11:05:02

28/05/2024 - 15:44:10

02/12/2021 - 11:34:53

01/03/2021 - 09:00:37

Opinions

18/05/2025 - 16:26:37

15/05/2025 - 20:16:04

Politics

05/06/2025 - 13:42:50

Terror Watch

Press Releases

05/06/2025 - 12:21:21

02/06/2025 - 21:29:33

0

0

Somalia's Porous Banking Can Be A Gateway for Money Laundering, Terror Financing

MOGADISHU, Somalia (HORN OBSERVER) - In recent years, Somalia has emerged as a significant source of remittances for its neighboring countries, Kenya and Uganda.